Award-winning PDF software

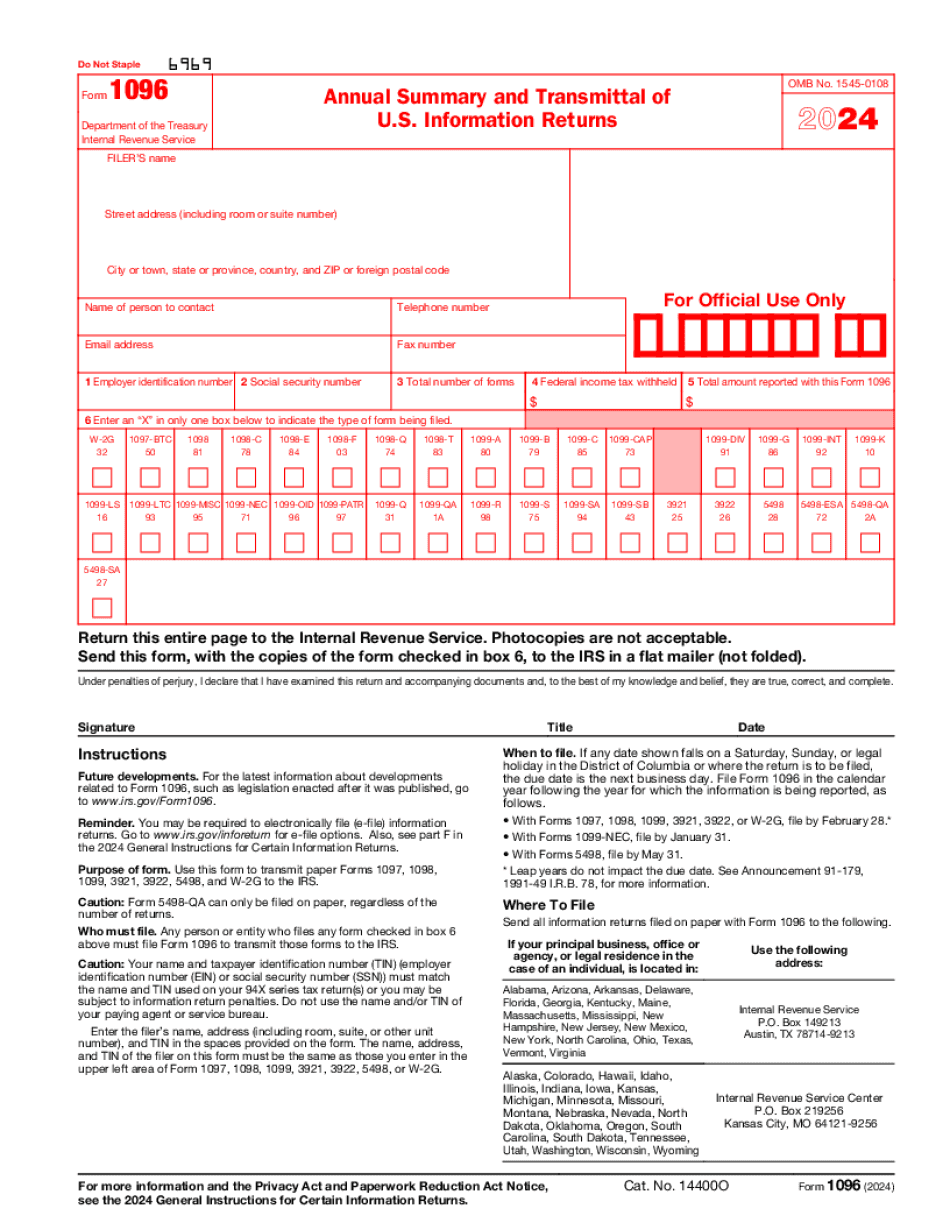

Toledo Ohio Form 1096: What You Should Know

Lucas County Taxpayer Service Center and the Lucas County Auditor and have issued a refund. If one is unable to view the report online, you may request the report at: This settlement amount is the total amount of cash refund as shown in the last row of the final column on the report. We have set up the settlement amount at 500.00 and the total amount of cash refund as shown at the bottom of the last column on the report. These amounts are calculated as follows. The total amount of refund is 500.00 divided by the number of returns made. If your settlement amount is less than 500.00 we will also refund your non-refundable taxes. We will refund the original amount of tax withheld in lieu of tax paid on a 500.00 settlement and the applicable balance at 0.00, 200.00, 50.00, 25.00, 12.50, 11.00, or 9.25. We will refund all taxes not already paid by the time the settlement amount is paid in full. You may be subject to a late payment fee. Your refund will also include an additional refund from the city that we calculated in Step B of this settlement. For additional information please contact the tax services office at 513.866.6672 Ext. 3222, Ext. 3322 or 513.866.6673 Ext. 3222. For tax assistance, please visit IRS.gov or Taxpayer.gov. If you did not have access to IRS.gov or Taxpayer.gov, you may have trouble finding this information. You may call us at toll-free and speak with a Customer Service agent. You may also send your request by email to. Please include your name, address and your phone number. Please include instructions with the request. Forms and Publications: All forms and publications are included in the settlement package. Forms and publications and their applicable information, including instructions for use and a reference, are available below. Attention filers and taxpayers of the forms and publications required by state law on or after January 1, 2017: — Ohio Revised Code section 469.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Toledo Ohio Form 1096, keep away from glitches and furnish it inside a timely method:

How to complete a Toledo Ohio Form 1096?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Toledo Ohio Form 1096 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Toledo Ohio Form 1096 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.