Award-winning PDF software

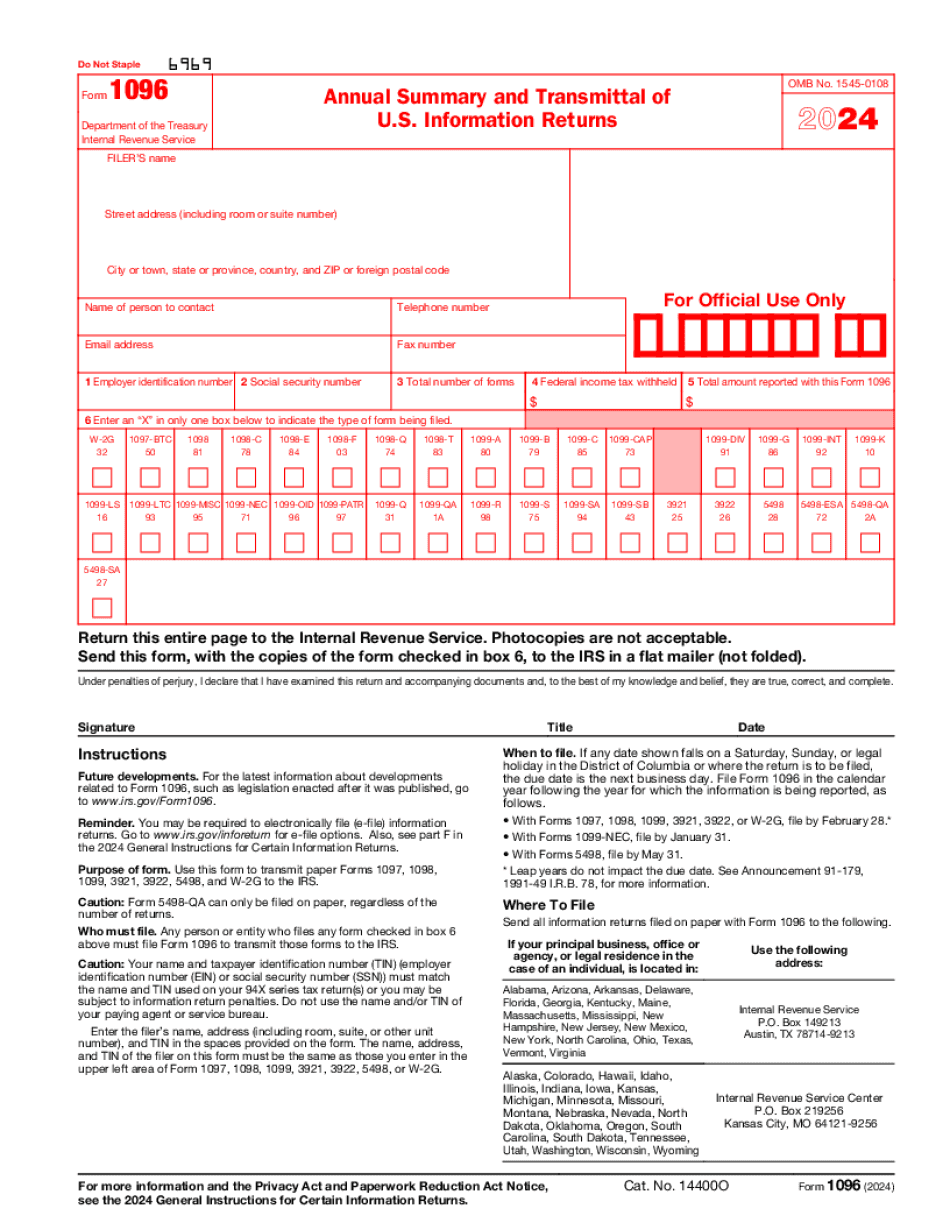

Printable Form 1096 High Point North Carolina: What You Should Know

Maine Income Tax Forms | Maine Revenue Maine Income Tax Forms. Sales & Use Tax: The General Use Tax is a tax that applies to the use and business activities of individuals. The sales or use taxes do not apply to rental properties, or to businesses that engage in both sales and non-cash transactions. Sales Tax Returns. Sales Tax Returns — Free Form. Use Tax. Use tax is a tax on taxable income paid or incurred in Maine. Learn more about the Maine Income Tax & Maine Excise Tax. Taxpayers can obtain information about tax returns and pay their Massachusetts state income tax online or by phone. Mail the completed and signed-off online return or payment via mail to the following address. Massachusetts State Tax Agency Massachusetts Board of Tax Appeals Attn: Return Processing 300 Beacon St., Room 516 Boston, MA 02 (Phone:) Online: Mass. General Revenue, Payroll (Mass. Taxpayer's State Account) If you are a Massachusetts taxpayer and want to access state income tax information, you can use the website and check the “Payroll” tab. Online: Mass. Tax Code. Maine Income Tax Forms by the Numbers! 1. What is the Maine Income Tax rate? 2. What is the tax rate for a married couple? 3. How much is the Massachusetts Maine Income Tax for a Single Taxpayer? 4. The Maine income tax is due on April 15. Which form is due? 1. Income tax rates. It applies to all legal residents, including those not taxed in their state. Those who are not taxed in Maine but resident in their home state, such as a student or temporary resident visa holder, may be subject to double taxation on income which they earned while in Maine. The tax rates for married couples are the combined federal and state taxes (10.95% for married individuals, 0.90% for joint filers, and the Maine personal exemption, which is not taxable on the first 5,500 of income). The tax rate for those with no income and living at a home in Maine but paying regular Massachusetts income taxes at that home is 0.94%). 2. Married, non-qualifying couples with no income. The state income tax rate on any married couple will depend on the amount of Maine income.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1096 High Point North Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1096 High Point North Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1096 High Point North Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1096 High Point North Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.