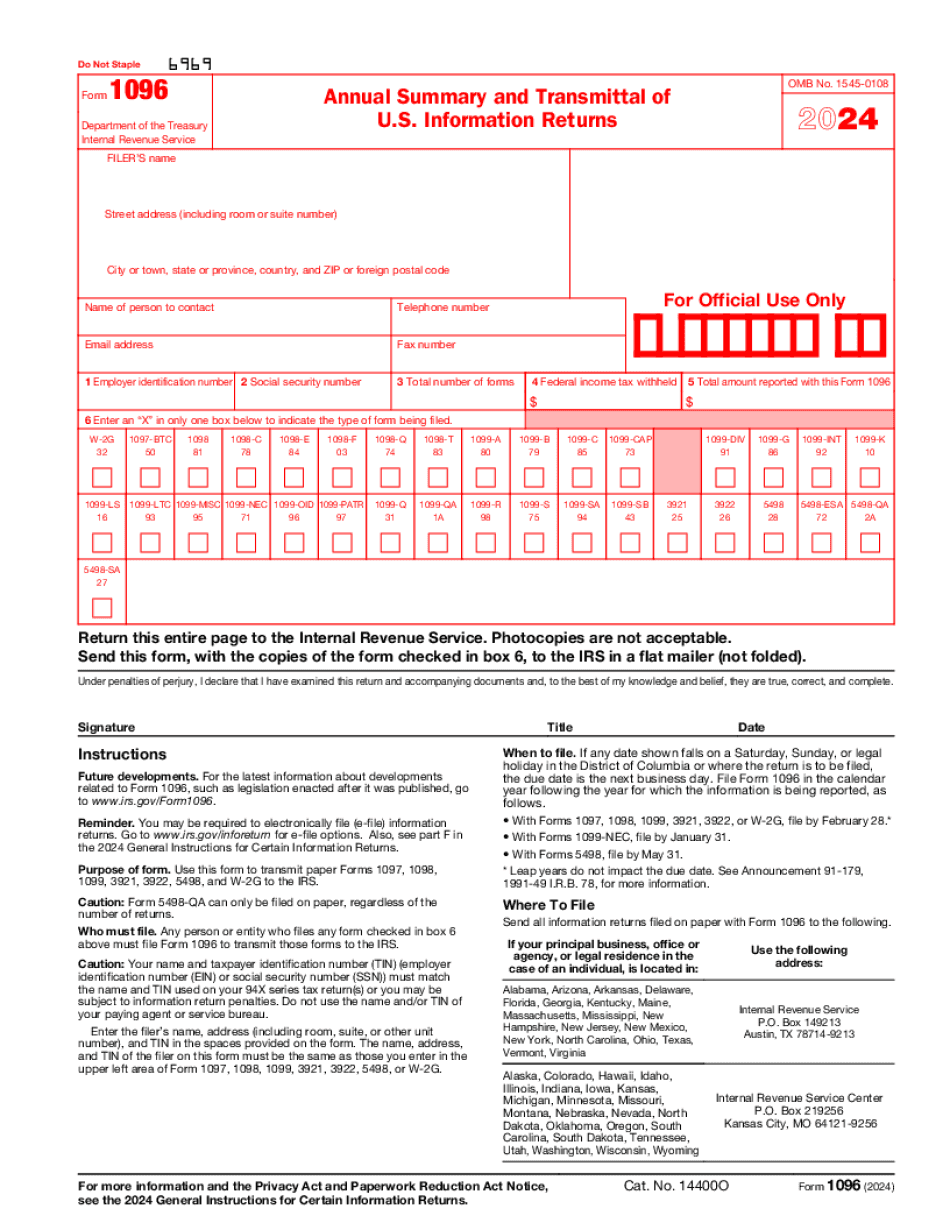

Downloadable PDF Form 1096 2024-2025

Show details

Hide details

Ore information about penalties. Transmitting to the IRS. Group the forms by form number and transmit each group with a separate Form 1096. For example if you must file both Forms 1098 and 1099-A complete one Form 1096 to transmit your Forms 1098 and another Form 1096 to transmit your Forms 1099-A. Future developments. For the latest information about developments related to Form 1096 such as legislation enacted after it was published go to www.irs.gov/Form1096. Reminder. The only acceptable ...

4.5 satisfied · 46 votes

1096-form-online.com is not affiliated with IRS

Filling out Form 1096 online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A full guideline on how to Form 1096

Every person must declare their finances on time during tax season, providing information the IRS requires as accurately as possible. If you need to Form 1096, our secure and user-friendly service is here to help.

Follow the instructions below to Form 1096 promptly and accurately:

- 01Import our up-to-date form to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Check out the IRSs official guidelines (if available) for your form fill-out and attentively provide all information requested in their appropriate fields.

- 03Fill out your document using the Text option and our editors navigation to be confident youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the toolbar above.

- 05Take advantage of the Highlight option to accentuate particular details and Erase if something is not relevant anymore.

- 06Click the page arrangements button on the left to rotate or delete unnecessary file sheets.

- 07Check your forms content with the appropriate personal and financial paperwork to ensure youve provided all details correctly.

- 08Click on the Sign tool and generate your legally-binding electronic signature by adding its image, drawing it, or typing your full name, then add the current date in its field, and click Done.

- 09Click Submit to IRS to electronically send your tax statement from our editor or select Mail by USPS to request postal document delivery.

Choose the best way to Form 1096 and report on your taxes online. Try it now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is Form 1096?

The totals from the 1099 forms are shown in the Irs 1096 Form. This is a compilation/summary return which have to be forwarded to the Internal Revenue Service along with one of 1099 papers.The document has to be submitted separately for every type of information return you have provided to a recipient.

The deadline for the 1096 Form has been changed for the 2025 tax year. An individual has to file it by January 31, 2018.

Note that usually there is no need to prepare this sample if you e-file 1099 blanks.

Note that usually there is no need to prepare this sample if you e-file 1099 blanks.

In case, you still have to pr1096, find the appropriate template on the internet, fill it out, sign, download to your device and forward to the IRS.

Once you have found the template, prthe required data. Read the following instruction in case you face this procedure for the first time.

- 01Write a name of your business and its address.

- 02Add a name of a person to contact and their email address, phone and fax numbers.

- 03Indicate your Employer ID Number or Social Security Number.

- 04Specify the total amount of forms you submit along with this example.

- 05Enter the entire federal income tax withheld.

- 06Prthe complete amount of reported payments.

- 07Indicate the paper you are submitting. Note! If the summary number of forms is 250 or more, you must submit them only electronically.

- 08Date and sign the document.

Once you have completed, download your example to your device and forward to the addressee.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 1096?

In order to prepare Form 1096 we need the following information to complete the return:

your personal and business information;

your address;

the total tax liability you have for the year;

details of tax offsets and items considered to be exempt;

details of the tax credits you claimed at your local office;

details of the tax credits you claimed at another office;

details of the credits you claimed in another country (other than the United Kingdom);

if you have a U.S. tax return or were required to file a U.S. tax return.

To help you fill out Form 1096, we need your personal and business information.

We also need:

your address

the total tax liability you have for the year;

details of tax offsets;

details of the deductions you claimed at your local office; and

Details of credits you claimed at another office, or other country.

Some examples of the personal and business information you need to supply are:

Your

Your name and address

Your home telephone number

Your home address.

The

Your full legal name

Your married name

Your marital status.

Our

Please enter the number you received in your correspondence from us.

Your

Your full taxpayer number. You are not required to enter your T2 number if you are not married.

The

The date, currency and place we are mailing you Form 1096.

The

The address we will be sending you the completed form.

When

The date, currency and place where we will mail your Form 1096.

The

The dates and/or locations at which we will be mailing Form 1096.

Please provide contact information for your representative, if you want this information to be kept confidential; however, this information is legally required to assist us in processing your return.

Your

Name and address of your representative. We also need these for reporting your returns to us.

Your (not your) address

Date of birth (mm-dd-yyyy)

Current Social Insurance Number

Telephone Number of your representative. You are not required to provide this number to us.

Who should complete Form 1096?

You may complete a Form 1096 to determine if you are eligible to participate in a governmental program. If you are eligible for a governmental program, you must complete the Form 1096 using the information that you provided on the W-2 Form or Form W-2c.

Do I need to do anything before filing a 1096?

No. The IRS will automatically file the Form 1096 to determine if you are eligible for a governmental program such as a Social Security or Medicare. You will need to submit a new 1096 after you are no longer eligible based on your social security income.

What information on my 1096 form must I provide?

If you believe your information did or should not match the information on our records, you must give us the information you believe is wrong in a Form 8300 or 1020-A, or a duplicate Form W-2c. When filling out the Form W-2c, you also must provide us with the dates the income was earned or received. Also, you must complete Schedule A, itemizing deductions, deductions, and credit and anti-abuse items. You cannot amend the 1096 form after it has been mailed or received at the post office.

How do I find out what information to provide on the 1096?

If you have any questions about the information to complete on your 1096 form, contact us at the address on your Form 8300, or by telephone at.

What if I am filing an earlier version of a 1096 using the wrong information?

If you are entitled to a public assistance program and did not complete a 1096 with the information that you have now, we can re-file the form as a 1096. As long as you can clearly prove that in the new 1096 you have included the correct information, we will process the 1096 on your behalf.

What if I am a worker?

If you are a worker, you must complete the 1096 electronically, and we will automatically process it. The 1096 is also processed by the SSI office. You cannot amend an electronic 1096 after it has been mailed or received at the post office.

When do I need to complete Form 1096?

The IRS wants to know when you are earning income, so they want to know when you file Form 1096. This is the time period for which income must be included.

For instance, if you are getting 2,000 of your 6,000 income from work-related taxes, that's where your 1096 reports should start. You must submit Form 1096 before that time period expires because the reporting will have ended at the start of the next calendar quarter.

If you are receiving more than 6,000 from different sources in a quarter, you must submit a separate Form 1096 for each quarter, for each source of income. If the taxes are on a recurring basis, you will fill out the Form 1096 for the entire year in advance.

The following table shows the deadline for filing the required Form 1096s for the most common sources of income. Keep in mind that these form deadlines are only estimates; they are not the exact deadlines. They give you the general idea of when you will need to file this form.

For more information about filing a 1096 and other tax information, see:

Can a Form 1096 reduce my taxable income?

Form 1096 may show a lower tax liability, but it is almost never a good idea to treat the 1096 as an actual tax return or pay a tax penalty. Remember that the 1096 report contains only information about what you paid taxes on. It does not report on the return any change in your tax situation, or how much you got back.

The main reason to report the information from Form 1096 as income is to make sure that you have your correct income or withholding and account information on hand, and to prepare your tax return without errors. If you get wrong information, you will have to file a corrected tax return, which costs you money. Also, you may have to pay taxes you never owed before you file a 1096.

What if I missed the IRS deadline when I filed my 1096. How will they know I missed it?

If you filed your form before the due date and the form was not on file the IRS sends you an original or postmarked receipt of it—or a notice that it is on file. If it is not on file, the IRS may send you a duplicate Form 1096, but that is not always a problem. Usually, you'll receive one of these notices because you filed at the correct time.

Can I create my own Form 1096?

Yes, you may create a Form 1096. You need to consult with an attorney or other tax professional to make sure it is the best for you.

I'm a non-U.S. citizen. Can I enter the U.S. using Form 1096?

No. You must obtain a visa to enter the United States.

Do I need to use a Form 1096 if I'm a non-citizen who lives outside the United States?

Yes, you must use a Form 1096 to submit a non-citizen claim to an international organization for assistance. See IRS Publication 519 for details. To find your local U.S. tax authority, visit.

How many years does IRS allow me to claim my foreign tax credit under current law?

See IRM 21.3.1.3.2, Nonresident Alien Credit (Form 1040), for the current amount of the foreign tax credit.

What if my foreign tax credit is over the foreign tax credit limit?

You must enter a foreign tax credit in the following formats when submitting it to U.S. government offices:

Form 1040X (or 1040NR)

Foreign Tax Credit Certificate (Form 2555) (for Form 1040)

U.S. Form 1040EZ (for Form 1040)

How can I claim my foreign tax credit when I entered the United States using Form 1040R?

See IRM 21.4.1.1.11, Foreign Tax Credit (Form 1040), for more information.

IRS Forms 1040X and 1040NR

Which are the different forms that I can use?

Under the Code and generally under the instructions for the form (see example of both Form 1040NR and Form 1040X in the previous question under “Forms To Use for Filing Status”), the code name is W–1. Form 1040NR is a replacement form; it eliminates the requirements for proof of citizenship and a U.S. employer. Form 1040x is a replacement form; it has no requirements for citizenship and a U.S. employer. An IRS form number is not needed for these forms.

What should I do with Form 1096 when it’s complete?

When you fill out the form, include all the following information: Your Social Security number and tax year for you, if you were paid benefits;

The total balance of your benefits, including interest and principal;

The amount you gave to each employer or employer's individual plan for employees covered by coverage under that plan (which may not contain the full set of benefits) and any unpaid balances owing to that employer's plan;

The amount you paid each provider for services, as noted on your W-2, if applicable;

Your employer's withholding, tax and FICA taxes;

Any employer contribution to your health insurance plan;

Any employer tax withheld from your wages;

FICA tax withheld from your wages and your employer's tax withheld from your pay;

Your Social Insurance Number (for coverage under FIFA) or an employer code (for coverage under Medicare);

Any deductions made from your social security payments.

Keep Form 1096 separate from Form 1099-MISC and all other government forms. It is best to keep it only for the periods of time we ask about, for example, the 3 years ending with the first taxable year. For more information and links to help you navigate Form 1096, go to the IRS website:.

What should I do if I received a tax refund or credit but cannot claim it on my W-2?

We cannot reimburse you based on the amount of any tax refund or credit or other refund you received as of the date the information on your Form 1096 was issued because such refund or credit was received after the first taxable year. If you received a refund on Form 1096, you can claim it on your next W-2 by filing Form 1040X, Amended U.S. Individual Income Tax Return. To see if the taxpayer filing Form 1096 is legally required to file Form 1040X on your behalf, see Is a Taxpayer Required to File a Business and Federal Individual Income Tax Return?

What should I do if I use the information on Form 1096 to make an adjustment to my tax return?

If you want to make an adjustment to your tax return based on information on Form 1096, file Form 1040X.

How do I get my Form 1096?

You can request a Form 1096 from the IRS free of charge in two ways. You can get free forms from any of the seven IRS tax center locations and from the IRS toll-free number. The telephone number in your area will provide you a code and toll-free instructions on how to request the form and file your return. You can request one free copy of your Form 1096 online in less than 15 minutes.

You can obtain copies of your Form 1096 by mailing the relevant information to the address on your form. Furthermore, you must include the original and copy of it as well as a note to request a copy of an updated Form 1096. Once you have mailed the necessary Form 1096 along with a statement requesting a copy of the form that is updated, please allow two-to-three weeks for us to mail your updated copy to you and give you a chance to respond. If you do not request a copy by the expiration date on the last two tax years (e.g., you are requesting a copy on July 31, 2010,, but you are eligible for a new Form 1096 for the year to determine what amounts to a current and previous payment), the IRS cannot send you an updated Form 1096 or a copy of your latest Form 1096.

My Form 1096 says my payment was made on June 25, 2010. Can I claim it from my 2010 and 2011 taxes?

Yes, you might still be able to claim 2010 or 2011 taxes as well as your payment for 2010 or 2011. The following applies: If you receive a Form 1096 within three years after making the payment you are claiming, and you filed a joint return for 2010 or 2011 with another person or have another child, the payment is not included in the computation of your adjusted gross income.

For more information, refer to Publication 906, Tax Withholding and Estimated Tax, and Publication 930, Tax Withholding Tables.

How can I claim the 95 penalty if I didn't remit or pay my estimated tax?

If you didn't remit or didn't pay your estimated tax, the amount for which you will be liable for a 95 filing penalty is equal to what you are owed, plus the balance due from the withholding agency. Amounts that are above the balance due must be paid before the IRS will issue a refund to the payer.

What documents do I need to attach to my Form 1096?

You may attach up to two (2) copies of your IRS return, including any attachments, for each item that will be reviewed.

What if I need to make changes to my return?

Any errors that are listed on the Form 1096 are corrected by the IRS. Before you file, we recommend that you do:

Identify all items on your Form 1096 that will be reviewed by the IRS. You'll be asked to describe exactly which item(s) you want corrected.

Correct any errors found on your Form 1096.

After you file, you can ask us to review your return. You can tell us whether we agree: by checking the “My Opinion” box on the statement.

To find out more about correcting a past-due tax return that hasn't been included or paid in full, click here.

What do I need to provide to the IRS in addition to the documents I attach to my Form 1096?

To be eligible to receive payments and refunds from the IRS, you must provide certain information, including:

Your Social Security number.

Your address and the mailing address of any authorized payment agent.

The date that the Form 1096 was received. The date you receive the first set of instructions to prepare a tax return.

The filing reference number you provided to the IRS for your tax return.

The number of copies or a certified copy(s) of Form 1096 that you plan to file.

You must report your changes to your Social Security number to your authorized payment agent. Your authorized payment agent is one of the organizations listed in the Authorization Section of this publication. These organizations are your only tax reporting agents for the current tax year and all prior tax years.

You may ask the IRS for information regarding the income reported on your Form 1096. This information will help us ensure that you are filing and paying the correct taxes from your earned income and, if applicable, your social security and Medicare withholding.

If you are requesting tax returns by mail, you should provide the following additional information:

The tax return number.

If any of your tax return items exceed 75.00 for each taxpayer, the total dollar amounts.

If you are requesting an estimated tax payment, you should provide the tax year and due date for payments.

What are the different types of Form 1096?

What are the different types of Form 1096S?

Form 1096-EZ

Form 1096-GR

Form 1096-G

Form 1096-PR

Form 1096-TR

Form 1096-S

Form 1096-Q

Form 1096-Q-EZ

Form 1096-Q-GR

Form 1096-Q-G

Notice: You may be subject to penalties if you don't include information required to report a loss or deduction and withhold.

If you make a capital loss in 2008 and 2009 to offset capital gains for the years 2009 through 2011, you may be subject to income taxes on any portion of your return not included in box 1 of Form 1096.

For a capital loss deduction, enter the amount of the capital loss in box 1, along with any other information, on the table below. The amount of the capital loss is reported on Line 5 of Form 1040, line 23. The total amount shown on the following lines of Form 1040 minus the amount in box 1 is the amount to enter on Form 1096(b) (if applicable). Enter it on line 8 of the Form 1096. If you make a capital gain in 2008 and 2009 and offset this gain for the years 2009 through 2011 on your 2009 through 2011 return, you should file Form 1046, Capital Gain Withholding. Do not file with paper Forms 1060 or 1095-A because you are liable for penalties for under-reporting capital gains and under-reporting income. Under the Internal Revenue Code, you may be liable for penalties if you fail to include or withhold the appropriate amount of a capital gain or loss. A capital gain is a gain on the sale of property. A capital loss is a loss on the sale of property. A capital loss deduction is a deduction claimed on any amount reported in box 1 of Form 1040 for any of the following activities: making investment decisions or buying and selling investments;

producing any kind of income, whether taxable;

producing any kind of income which is a gain if, when combined with another taxable income, the adjusted basis of the property exceeds the adjusted basis of each of the other property;

or using any part of the net income from any business in determining gross income.

How many people fill out Form 1096 each year?

It's complicated. “I am not sure,” says Robert McIntyre, who studies the issue. Form W-2 is filled out by workers in the United States, while IRS Form 1099 is filed in more than 120 countries in more than a dozen languages. (IRS employees who work in tax havens, such as Panama or Switzerland, are required to use W-2 forms, because the IRS and the rest of the federal government don't have access to the forms they fill out.) The U.S. income tax has several loopholes, but the IRS has a special tool that lets the government track and collect the information and return a check to taxpayers in foreign countries. And the agency has a program called a Foreign Bank Account Information, or FAR, to help U.S. taxpayers overseas keep track of their bank accounts. “I can't say how many nonresident aliens (U.S. citizens or resident aliens) fill out W-2s,” McIntyre says. I am not able to say how many Americans report income that is not reported on their tax returns. “You could say the government is trying to find any way it can to get money from nonresidents to the United States,” says David J. Williams, who tracks government tax policies for the Center on Budget and Policy Priorities.

“The government is taking advantage of its ability to monitor what people do,” says Williams. “There are a number of nonresident aliens who work in tax havens.”

In addition to the 100 million it collected in 2001-2, the IRS reports its collection of foreign bank accounts and refunds in IRS Form 990 that is posted on an IRS Web page. This data is not updated.

Taxes Are Still Too High

The IRS does not have much data from 2001-2 that allows its experts to say how much of the federal budget is lost when foreign workers take their share in U.S. tax revenues. However, there are some clues. “The tax code and tax rate structure has not changed as much as one would think,” says John Human, a tax policy professor at the Brookings Institution and a critic of the U.S. approach to taxation. “It is still way too high, particularly on income taxes and capital gains. The top income tax rate is 35 percent. Meanwhile, the top capital gains tax rate is 15 percent.”

U.S. companies do not pay their taxes, Human says, because they make a lot of money overseas.

Is there a due date for Form 1096?

Yes. Form 1096 must be filed on or before the due date of the return for which tax was taken.

However, if the IRS wants the return filed on the due date, a timely submission will ensure timely payment.

What happens if I don't file this Form 1096?

An IRS representative may contact you at the address shown on your Form 1096 to ask to see it. For this reason, the IRS will usually not contact you if you do not file the Form 1096 by the deadline (see question 3).

What if I have additional questions?

For more information, contact the IRS for instructions or submit a comment using our online form.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here